In October, the Task Force on Climate-related Financial Disclosures (TCFD) released its 2022 Report in which it reflects on five years of significant developments and progress made since its first report in 2017 towards its goal to increase the quantity and quality of climate-related financial disclosures by companies, asset owners, and asset managers. In this extended blog we offer a guide to making the most of this very rich and useful resource, which is valuable to any company on the path to Net Zero (or simply to reducing their emissions), and to investors seeking to decarbonize their investment portfolios.

Before we jump into some of the key takeaways to be found in the report, let’s start with a reminder of the purpose of the TCFD and the context in which it was created.

TCFD: Background and Context

The Financial Stability Board received the mandate from G20 Finance Ministers and Central Bank Governors in 2015 to help identify the information needed to assess and price climate-related risks. To do this, the FSB established the TCFD, an industry-led task force, and gave it the mandate to develop voluntary climate-related financial disclosures that would be useful to investors and others in understanding material risks.

The original concern leading to the creation of the TCFD recommendations was that inadequate information about climate-related risks could lead to a mispricing of assets and a misallocation of capital, potentially leading to market vulnerabilities. The aim was therefore to create a framework of recommendations that would enable company disclosures on climate-related financial information to become more complete, consistent, and comparable, with a more appropriate pricing of climate-related risks and opportunities.

As the world transitions to a low carbon or net zero economy, there needs to be a way to ensure that companies can reduce their emissions and transform their business to align with the new landscape smoothly, without causing economic shocks that could make it a very bumpy ride for everyone.

Pricing is important in this context because investors need to understand how the financial performance of companies is likely to be impacted by their specific climate-related risks and opportunities. The higher the risk of a negative financial impact of climate change on the company, the higher the cost of capital will be for that company and the more wary investors will be about investing in it. This then becomes a real financial incentive for companies to reduce their emissions, leading (hopefully) to a positive outcome for the planet and its inhabitants.

Key Takeaways from the TCFD 2022 Report

Without seeking to summarize the Executive Summary, which is well worth a read, the top line message it offers is essentially: we’re making encouraging progress on the adoption of the TCFD recommendations – both in terms of increasing levels of disclosure by companies (quantity and quality) and in terms of their underlying implementation efforts – however more urgent progress is needed, and companies are still not disclosing enough decision-useful information.

The report draws attention to the sobering warnings from the IPCC that despite all the net zero commitments by governments and companies, the world is still heading to warming well above 2°C compared to pre-industrial levels. In addition, progress on aligning financial flows with low greenhouse gas emission pathways remains slow, with climate-related financial risks still greatly underestimated by financial institutions and markets. In other words, the money that needs to be invested in financing the carbon transition is still not flowing to the companies that are best placed to decarbonize the economy.

With that, let’s take a closer look at some of the content presented in different sections of the report that can potentially help spark ideas for how companies can take disclosure and implementation to the next level.

A. State of Climate-Related Financial Disclosures

This section of the Report is composed of two main parts:

- a review of 1400 public company disclosures (annual reports, financial filings, sustainability reports etc.) from different geographies and sectors covering a three-year period (fiscal years 2019, 2020, 2021) using an AI methodology

- a review of reporting by Asset Owners and Asset Managers through a survey

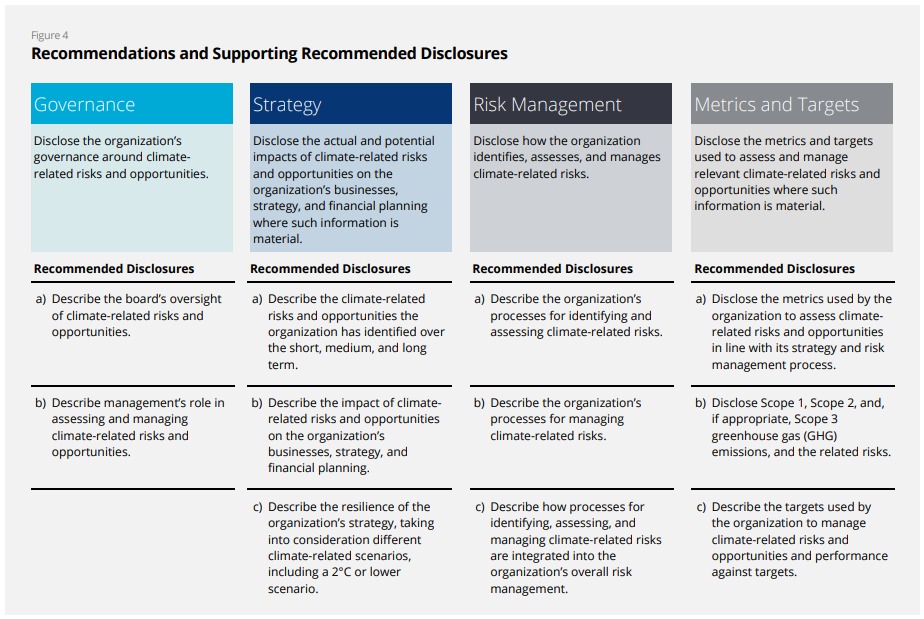

In the company section, key take-aways and findings, nicely summarized in easy-to-read graphs and charts, are accompanied by one company example for each of the 11 TCFD recommendations covering the four categories: Governance, Strategy, Risk Management and Metrics & Targets (see the image below). These examples – which are extremely useful for companies at an early or intermediate stage of TCFD disclosure and implementation – were included by the Task Force not as best practices but as examples of how disclosures are currently being made and that can help companies generate ideas for their own disclosure. This reflects one of the key messages that comes through loud and clear in the Report, namely that this is a journey, and it is best to start somewhere ASAP, and improve on the basis of what has been learned than to wait and hope to get everything right later.

Many of the examples are in fact qualitative, not quantitative – for example, under recommendation Strategy b), “Describe the impact of climate-related risks and opportunities on the company’s business, strategy, and financial planning”, one company’s table identifies the introduction of carbon pricing, or carbon tax emissions trading as a risk that would increase the cost of procurement of raw materials and which can be addressed by actively supporting suppliers in the decarbonization of their activities. While it might take longer to be able to quantify the impact of this risk and express the tangible benefits of any action taken to decarbonize the supply chain, it is clearly a good start and opens pathways for further analysis and implementation. Companies can then build on this kind of qualitative information by disclosing key metrics and targets, as shown in some of the other examples given in this section.

A few of the other key points that emerge from this section include the following:

Climate-related metrics: One of the TCFD recommendations on which there has been the smallest increase in terms of percentage of companies reporting is Metrics and Targets Recommendation a) Climate-Related Metrics (at 47% in 2021 vs. 46% in 2020, and 42% in 2019). While the disclosure level is relatively high, growth is slowing, and yet these metrics are identified by investors and other users as one of the top two most useful disclosure elements for decision-making.

In a later section of the Report presenting the results of the Review of Five Years of TCFD Implementation (TCFD Implementation Survey), the biggest necessary improvement that is identified by investors and other users of disclosures is for companies to include standardized, industry-specific climate-related metrics in their disclosures.

Taken together and seen in the context of the work by ISSB and other standard-setters to create a global baseline for carbon disclosure, these two points serve as clear signposts for ways in which companies can work towards making their disclosures more decision useful. The Task Force points companies to a key resource on this subject – Guidance on Metrics, Targets and Transition Plans – where it includes the seven categories of climate metrics all companies should disclose.

Strategy resilience under different scenarios: The AI review shows that in 2021 only 16% of companies disclosed on Strategy Recommendation c) “Describe the resilience of the company’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario” vs. 12% in 2020, and 6% in 2019. The challenge posed by this recommendation is confirmed by the TCFD Implementation Survey results in which 80% of respondents (companies) stated that this recommendation is somewhat difficult or very difficult to implement. Recognizing the significance of this challenge for companies, elsewhere in the Report the Task Force points readers in the direction of two valuable resource documents:

- Guidance on Scenario Analysis for Non-Financial Companies

- The Network for Greening the Financial System’s “Scenarios Portal”

Governance: An intriguing inconsistency comes to light between the results of the AI review of disclosures, in which Governance remains the least disclosed recommendation, and the results of the Implementation Survey, where survey responses by companies indicate that Governance Recommendation a) “Board Oversight” and b) “Management’s Role” are very easy or relatively easy to implement.

The authors of the Report speculate that this may be either an inconsistency resulting from their AI methodology or perhaps it reflects the difficulty companies face in obtaining support from boards on including these governance-related disclosures in public reports. This is particularly interesting when seen in the context of a later section of the TCFD Report which is dedicated to Case Studies on Board Oversight.

The experiences shared by the seven companies featured in the case studies highlight just how critical board oversight of Climate and Sustainability-related matters is to successful implementation of these strategies. This section contains some very valuable lessons learned and advice from companies that have been working on TCFD implementation for several years (read on for a selection of these).

B. Review of Five Years of TCFD Implementation

This section presents the results of a survey of 399 companies, investors, and other organizations designed to better understand the status of companies’ implementation of the TCFD recommendations over the past five years, including associated challenges, and to obtain views from the users of financial disclosures on the usefulness, availability, and quality of the disclosures.

The results are summarized as progress vs. objectives in the context of the milestones defined by the TCFD leading to the desired outcome of more complete, consistent, and comparable disclosures enabling more appropriate pricing of climate-related risks and opportunities. The survey respondents had all signed up for updates on the TCFD website, and so the Task Force cautions that the survey results should not be extrapolated to a broader population of companies.

Here are a few points from this section that struck us as particularly useful or significant:

On the Governance recommendations, one of the key challenges companies face is a lack of expertise within the board and senior management. It’s worth noting that the case studies on board oversight presented later in the Report highlight the fact that the process of beginning to implement the TCFD recommendations is itself a significant learning exercise for the board and top management, leading to greater understanding, commitment, and involvement on climate and other sustainability-related matters.

While the highest level of reporting over the 5-year period was on Metrics and Targets Recommendation b) “Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks”, Scope 3 remains a major challenge for companies and therefore results in lower levels of disclosure. No surprises there.

The percentage of companies that disclosed climate-related information in financial filings, annual reports or integrated reports increased from 45% in 2017 to 71% in 2021, with more than 60% of companies also disclosing information in sustainability reports. Together with the fact that 98% of companies surveyed said that Strategy Recommendation b) “Describe the impact of climate-related risks on the company’s business, strategy, and financial planning” is very useful or somewhat useful for making financial decisions, we begin to get a sense of how climate-related matters are filtering into the mainstream thinking of business leaders through the financial artery of their organizations.

Users of climate-related financial disclosures state in their survey responses that in addition to standardized industry-specific climate metrics (which they say are best defined by ISSB and EFRAG), what they want to see from companies is the disclosure of actual and potential financial impacts of climate change, the use of a standard scenario to assess resilience of their strategies to climate change, and for companies to report their climate-related targets in a consistent way.

On the subject of consistency, the Task Force notes that companies can make their disclosures more accessible for users by avoiding fragmenting climate-related information across different locations from year to year (e.g., in different reports and web pages). Consistency makes it easier to locate key information, and indices or signposting across multiple reports is also very helpful.

Another useful observation along the same lines is that most companies only included a single year of GHG emissions information, whereas they should be presenting multiple years of emissions using a consistent emissions methodology in a single report. This historical data is important, the Task Force explains, to help users to better understand the context, the related issues, and the potential need to make stronger reductions in later years if earlier interim targets are not met.

When disclosing on the Strategy recommendations, companies enhanced their presentation of the risks and opportunities they had identified by adding in time horizons and estimated likelihoods associated with risks.

More than half of companies surveyed in the review included information on their transition plans in 2021, with a few releasing dedicated transition plan reports. These represent a great source of learning for companies at earlier stages of their journeys, which can travel the path more easily thanks to the pioneers who have hacked their way through the heavy undergrowth, so to speak.

On Risk Management Recommendation c) “Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the company’s overall risk management”, the Task Force explains that a common company concern has come to light that this recommendation might entail a separate process within the company’s overall Enterprise Risk Management process. The Task Force dispels this concern, reassuring companies that there is in fact no need for separate processes for Climate within an ERM. This point will hopefully bring relief to some companies out there experiencing difficulty on this point.

In the section summarizing the TCFD’s extensive research on the pricing of climate risks, a clear sense emerges that markets are beginning to price in these risks, leading to a higher cost of capital, and greater barriers to accessing capital for companies that either do not disclose relevant financial information or that are clearly not embracing the transition to a low/zero carbon economy. Crucially for companies, it is noted in this section that while higher emissions are often attributed to higher credit risk, company practices of disclosing emissions, and setting a forward-looking target to cut emissions (with a viable transition plan) are both associated with lower credit risk.

This section ends with an exhortation from users to companies to ensure that their disclosures include all important decision-useful information and move away from the current generic language that is uninformative, imprecise and insufficient to assess their risks. Three points are mentioned that will make the difference here:

- Continuous refinement of disclosure standards

- Development of comparable and efficacious risk metrics

- Improved data quality and data management

C. Case Studies on Board Oversight

There is a lot of valuable information to be found in the penultimate section of the Report, where seven companies share learnings and advice drawn from their implementation journeys. Here is our selection of a few golden nuggets:

A holistic, strategic approach to Climate: One very clear and significant take-away is that these companies have all elevated oversight for Climate (and very often for Sustainability generally) to the highest governance level, i.e., their board. This move goes hand-in-hand with the integration of climate and sustainability-related targets and KPIs into executives’ and other employees’ short and long-term incentives.

In addition, it is clear from most of the case studies presented that Climate is now a core pillar of their business strategy. Most of the companies highlight the importance of cross-functional committees (including Finance, Risk, Legal, Compliance and Operations) and distribution of roles and responsibilities for climate-related targets across the company.

Several companies highlight the importance of company culture in achieving this deeper integration throughout the organization, including by developing processes to communicate key data and information between different departments and working to eliminate silos. Impex shares that their company’s mindset shifted at all levels after they established their “Corporate Position on Climate Change” at board level and put responsibility for their medium-long term strategy under the CEO.

Making time and space for climate-related work: Another important point, which emerges from the Singtel Telecommunications Group’s case study, is that boards and management cannot set emission reduction targets before undergoing a baselining exercise, which it can take several years to refine to the point that figures can be externally assured. As Aviva notes in its case study, boards get nervous when it comes to new disclosures without the usual level of assurance.

Singtel underlines that, in their experience, it also takes time to carry out a financial analysis of climate-related impact, to model against different scenarios, as well as test and refine assumptions. It says that implementing TCFD helps to prepare for the ISSB standard, which is under development, as it enables the board and management to link the material impact of all of their key sustainability issues to financial disclosures, and to ensure they are embedded in robust governance processes.

Seeing climate-related opportunities as well as risks: Several companies highlight the importance of focusing not only on risk, but on business opportunities. For example, Impex Corporation’s board reviews quarterly progress of five new Net Zero business strategies. They learned that climate risks and opportunities have significant implications for the whole business, not just parts of it.

Similarly, Holcim combined the responsibility for Sustainability and Innovation in a single CSIO position at Executive Board level and involved 100 people across the company in the process of building a transition model to understand what it would take to achieve an ambitious carbon transition plan, which was cascaded down to plant level.

Evaluating and disclosing the economic feasibility of emission-reduction plans: Canada Pension Plan noted that a significant gap that they identified as an investor, is that the market currently has no convention for issuers (i.e. companies) to report the economic feasibility of delivering against their commitments. They developed an Abatement Capacity Assessment Framework to fill this gap and are piloting it with companies in their investment portfolios.

This highlights the importance for companies to find ways to communicate to investors what the costs of their transition plans are likely to be and how they are assessing and prioritizing actions on a cost-benefit basis.

D. Initiatives Supporting TCFD

In this final section of the TCFD Report, there is a useful summary of all the key TCFD-aligned disclosure requirements and proposals in different jurisdictions, illustrating how much traction the TCFD requirements are getting among governments and regulators in addition to a wide range of other organizations such as stock exchanges, international and regional standard-setters and industry organizations.

In conclusion of this review of the TCFD 2022 Report, there can be no doubt that there is great momentum underway. The ball is rolling on climate-related disclosures and on implementation of the TCFD recommendations. If you are a company, you definitely want to be on board surfing that momentum, not seeing it barreling towards you without being prepared.

Ready to start reporting to the TCFD Framework? FigBytes can help! Our ESG Insight Platform has multiple pre-programmed frameworks including TCFD to help you streamline your ESG Reporting.