The 2050 deadline to meet the Paris Agreement commitments for a net zero economy may still feel like a distant date, but the time to act is now. The first checkpoint in 2030 is only seven years away, and we need to cut emissions by at least 45% by then; a challenge when global emissions continue to rise.

But while a lot of the focus is on resource-intensive industries like oil & gas, the financial sector has a critical role to play if we’re going to reach our net zero goals. Initiatives like Environmental Social and Governance (ESG) reporting are designed to help businesses from all sectors understand their carbon emissions and how to reduce them. In particular, standards like PCAF Carbon Accounting are designed specifically for the financial sector.

Why Do Financial Institutions Need ESG Reporting?

When the general public imagines a business undertaking things like carbon accounting, it’s easy to picture how it works in sectors like manufacturing, power generation, and oil & gas. These can be emissions-intensive sectors and it’s simple to envision what activities they might undertake to reduce their carbon footprint.

With financial institutions, there may not be significant direct emissions like there are in other sectors. But that doesn’t mean these institutions can’t have an impact on the global carbon landscape. Banks around the world still have $4.6 trillion invested in the fossil fuel sector. That investment means there is a significant potential to direct the future of the industry.

Banks play a critical role in moving businesses toward a net zero economy. Their investment will help facilitate the transition to low- or no-carbon activities. Financial institutions need a standardized methodology to show progress and identify risks and opportunities within an investment portfolio.

What Are Financed Emissions?

Financed emissions refer to the portion of carbon emissions that are made possible by a financial institution’s investment. Depending on how that investment is structured, it could be estimated as the organization’s entire carbon footprint, or a proportion based on the size of the investment versus the company’s complete debt and equity.

Ultimately, financed emissions is about calculating the absolute amount of carbon generated and released, as well as the amount recaptured or avoided, as a result of the institution’s contribution to the economy.

What Are the Available ESG Standards?

There are a variety of ESG standards that have been developed and consolidated over the years. The goal is always to standardize climate and sustainability reporting so that investors and stakeholders can easily compare data on an annual basis and between businesses across sectors and in different countries.

Some of the ESG standards include:

- CDP – applicable to public and private sectors, the CDP includes reporting focusing on climate, water and forestry. For reporting organizations, their CDP Score is made publicly available each year.

- ISSB/SASB – a relatively new standard, this standard aims to integrate sustainability reporting into financial reports

- TCFD – this framework is designed to help investors, lenders and insurance underwriters make informed decisions among their portfolio and assets

- BRSR – India’s new ESG standard was introduced in early 2023 and requires reporting beginning with the 1,000 largest companies in the country

- CSRD – an EU-specific ESG standard, the roll out of this standard will begin with the largest companies in 2024, but will ultimately require reporting from small and medium-sized businesses too

- SEC Climate Disclosure rules – still in development, this American standard will mandate ESG reporting as part of SEC filings

- PCAF – while many standards focus on helping organizations quantify direct emissions and impacts of their operations, the Partnership for Carbon Accounting Financials (PCAF) is designed for financial institutions to help them measure climate impacts of their portfolio

What Is the PCAF Standard?

The PCAF Standard is also called the Global GHG Accounting and Reporting Standard. It’s designed to assess and quantify GHG emissions in the financial sector. There are three parts to the standard. These are financed emissions, facilitated emissions, and insurance-associated emissions.

The standard for financed emissions include reporting guidance across a number of financial asset classes including:

- Listed equity and corporate bonds

- Business loans and unlisted equity

- Project finance

- Commercial real estate

- Mortgages

- Motor vehicle loans

- Sovereign debt

The facilitated emissions standard is new in 2023 and has yet to be fully released and will provide guidance on estimating and reporting GHG emissions related to capital market transactions.

The insurance-associated standard includes methodologies for reporting GHG emissions to the re/insurance underwriting sector.

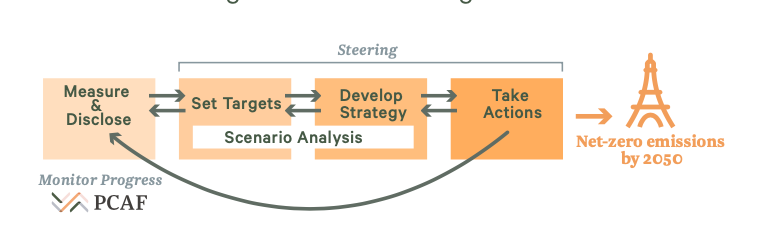

Under all parts of the PCAF standard, the goal is to follow a four-part process that ultimately leads to net zero emissions by 2050. As shown in the image below from the PCAF standard, this process includes the following steps:

Source: Part A – Financed Emissions 2nd edition (2022)

Although the PCAF standard is industry specific, it is being implemented around the world, with implementation teams operating in five regions: Africa, Asia-Pacific, Europe, Latin America and North America.

Reporting Financed Emissions to PCAF

Understanding GHG Emissions

Under the PCAF standard, carbon accounting looks not only at generated GHG emissions, but also at removed emissions and avoided emissions.

Generated emissions are what we think of most often when we consider GHG emissions. These are those created and released as part of business operations, or–in the case of financial institutions–as part of operations resulting from bank investments.

Generated emissions also include indirect sources that what we typically see in other GHG standards. These are the Scope 2 and 3 emissions that result from sources like purchased electricity or supply chain emissions.

But not all investments result in GHG emissions. In fact some, like investing in growing the forestry sector, or carbon capture may actually result in removing carbon from the atmosphere. And other investments may result in avoiding these emissions by funding projects like clean energy infrastructure.

While it’s important to highlight generated, removed and avoided emissions, under the PCAF standard, these should be reported separately, not as a net carbon number. Without this level of granularity, reporting financial institutions will not be able to identify areas for improvement in future years.

Setting Business Goals

Effective ESG reporting has to align with business goals or else it’s just an administrative exercise. As companies are starting out with their report, it’s important to clearly state the goals of their ESG program and how it aligns with larger business priorities.

Every institution’s goals will be different, but PCAF suggests the following as a starting point:

- Creating transparency for stakeholders. Transparency is one of the key motivators in sustainability reporting, especially in the financial sector. Investors want to see how their money is being spent and who is benefiting from it.

- Managing climate-related transition risks. The transition to the net zero economy isn’t always smooth sailing. Companies may have to incur additional costs to offset carbon generation, or make capital investments without immediate payback to meet their commitments. Financial institutions need to be able to identify what risks exist in their portfolio while organizations complete their transition.

- Develop climate-friendly products. Within financial markets, green products are emerging, helping financial institutions decide which sustainability projects to fund and how to prioritize future investments to better support carbon reduction opportunities.

- Align financial flows with the Paris Agreement. Financial institutions play a critical role in setting and meeting science-based net zero targets in accordance with the Paris Agreement. Using ESG frameworks will help them better understand the absolute carbon footprint for their investment portfolio and where changes are needed to meet targets.

Your organization may have additional goals you want to meet, or you’ll need to tailor the goals above to better reflect your operations. Either way, a clearly stated list of goals is critical before you can set measurable and material targets.

Completing GHG Accounting

The core principles of GHG accounting are as follows: accuracy, transparency, completement, consistency, and relevance. In order to be valuable to financial institutions and useful to investors and stakeholders, GHG accounting needs to yield high quality and verifiable data so that progress can be traced year over year.

Financial institutions will measure or estimate the GHG emissions for which they have operational or financial control. These are either reported as Scope 1 (direct) or Scope 2 (indirect) emissions.

If the institution has additional loans and investments that result in GHG emissions beyond their operational or financial control, these are reported as Scope 3 emissions, similar to the way other companies report Scope 3 for emissions from their value chain but outside the organization.

In addition to measuring emissions from each scope, GHG accounting also needs to provide commentary on data quality. High-quality data may not be available to financial institutions throughout their portfolio, but assessing data quality identifies areas for improvement over time.

Methodologies for Measuring GHG Emissions

Under the PCAF carbon accounting standard, methodologies are prescribed for each of the seven asset classes. As a reminder, these are:

- Listed equity and corporate bonds

- Business loans and unlisted equity

- Project finance

- Commercial real estate

- Mortgages

- Motor vehicle loans

- Sovereign debt

The financial institution will report all the Scope 1 and 2 emissions of each party under each asset class. Scope 3 emissions are being phased in to relevant asset classes, based on the understanding that these will be more difficult to quantify in early years of reporting, particularly for sectors that are also new to ESG reporting.

How institutions calculate their financed emissions will depend on the available information from their portfolio. Where possible, the best data quality always comes from directly measured and reported numbers, but these may not always be available or communicated to the bank.

An alternative is to use physical activity-based emissions. This would be something like estimating GHG emissions based on the amount of natural gas consumed by a business. This information, along with published emission factors, can be used to estimate emissions. The institution would then attribute a portion of that estimate as those emissions that resulted from their financing.

Another method would be to use economic activity-based emissions. This method can be the least accurate, but uses metrics like revenue to estimate emissions based on a per-unit-of-production basis.

For asset classes like commercial real estate, the methodologies may be different. Direct measurement is still preferred, but estimates based on metrics like square footage or the number of buildings being reported on can be acceptable.

This variation in methodologies is why data quality and transparency on calculations is so important. In order to provide the best context for investors and stakeholders, financial institutions should prepare their report to a level of granularity where disclosure is meaningful. This usually means reporting on a company-by-company basis.

In addition to carbon emissions generated, financial institutions will also report on carbon captured, both through natural and technological means, emissions avoided, as well as carbon credits generated and retired.

Where To Start With PCAF Accounting?

Implementing a new ESG reporting program can be a significant undertaking for any company, and preparing a report that pulls data across an entire portfolio can be especially labor intensive.

Providing a complete and accurate picture of financed emissions is critical for transparency and to achieve net zero goals, but actually painting that picture in a useful and meaningful way is a daunting task.

A sustainability platform like FigBytes can help streamline your ESG data collection and prepare a comprehensive and validated report. The cloud-based software solution means you can send data requests directly to portfolio organizations, saving yourself valuable time on data entry.

FigBytes also uses validated calculation methodologies so you don’t have to reinvent the wheel when estimating emissions across your portfolio. We use methodologies approved by standards and organizations like PCAF, CDP and TCFD, meaning your data will be consistent and comparable across the industry.

ESG is an important tool to evaluate risk and a worthwhile undertaking as part of meeting the world economy’s Paris Agreement commitments. But your business is finance, not report writing. Using a tool like FigBytes means your ESG program is set up for future success from the beginning. For more information on how FigBytes can help you understand financed emissions and ESG reporting for financial institutions, speak with one of our solution advisors today.