On September 20, 2023, in an attempt to quell the greenwashing of ESG investment funds, the U.S. Securities and Exchange Commission (SEC) announced the adoption of amendments to the “Names Rules” under the Investment Company Act.

These new amendments mean that any investment fund that indicates in its name that it supports Environment, Social and Governance (ESG) goals (or any other thematic goals, for that matter), must invest at least 80% of the value of their assets in investments that also support those goals.

Though this may seem obvious, it hasn’t always been the case.

In fact, for years, many ESG funds have been padded with investments that aren’t green at all, in an effort to offset low-return ESG investments and bring optimal returns to investors.

According to a study by ESG Book that assessed 420 ESG funds and 95 climate funds, 14% of these green-branded funds actually produced carbon emissions intensities higher than the average across all funds. They also found that many climate-named funds actually invest in fossil fuel and mining companies.

The name of a fund, and the marketing around it, is important because that’s often what investors use as a first signal when making investment decisions. The new amendments demand more transparency in fund names, as well as additional reporting and disclosure requirements, in an effort to halt deceptive behavior.

In this article, we look at what greenwashing is, the actions the SEC has taken to crack down on greenwashing, and steps your organization can take to avoid greenwashing.

What Is ESG Greenwashing?

The concept of greenwashing, and its closely-related cousins purpose-washing, cause-washing and climate-washing, isn’t new in the ESG space unfortunately.

Greenwashing is the act of making false claims about the environmental or climate impact of a goods or service. Greenwashing also happens when businesses spend more money and time on marketing their supposed positive environmental impact, than actually taking action to ensure they’re making a difference.

The UN says greenwashing poses a significant barrier in tackling climate change, specifying ”greenwashing promotes false solutions to the climate crisis that distract from and delay concrete and credible action.”

Greenwashing can look like the following:

- Companies purposefully withholding information or being vague about their operations or impact.

- Businesses saying they have a robust ESG strategy or standards in place, when in reality they don’t.

- Organizations overstating the impact of small improvements they’re making towards sustainability.

- Companies making unverifiable statements due to missing steps in the due diligence process.

- Organizations focusing on one positive impact they’re making to distract from non-action or harmful actions.

- Businesses making false or misleading marketing claims to increase the perceived value of a goods or service.

When applied to the investment industry, greenwashing makes it difficult for investors to distinguish between funds that are using truly green strategies and those that are just saying they are.

The SEC defines greenwashing as, “the act of exaggerating the extent to which products or services take into account environmental and sustainability factors,” and studies have shown this practice to be rampant in the investment industry.

In fact, after analyzing 515 climate- and ESG-branded investment funds, the ESG Book found that:

- seventy-three of ESG funds (14%) showed a “greater emissions intensity ratio” than the average recorded across 36,000 total funds; and

- fifteen ESG funds (3%) “exceeded 400 tons of carbon dioxide equivalent per million dollars of revenue – more than twice as high as the wider average”.

Additionally, they found that many of the 95 climate-specific investment funds analyzed were actually investing in fossil fuel and mining companies, which goes against the principle of net zero even when these companies have their own offset programs in place.

Why Is Greenwashing a Challenge?

The main challenge around greenwashing is that, to date, there has been no one single definition around it or means of measuring it.

Greenwashing may look different based on the product or service in question, the industry it’s serving, or the values of the person making or receiving the claim. In an article from Harvard, the authors state bluntly: “one person’s treasured sustainability claim can be another person’s greenwashing trash”.

Moreover, accusations of greenwashing have, so far, been relatively easy for companies and their marketers to skirt around. Without requirements to disclose numbers, data, science, or the full story, it’s been easy for businesses to overstate, exaggerate or be non-specific about their environmental impact in favor of their bottom line.

However, recent developments by various bodies, the SEC included, are making it so that greenwashing is coming with increased regulatory, reputational and litigation risks.

Every day, more companies are being called out for greenwashing, and it’s easy to Google lists of accused offenders, compiled by environmental watchdog organizations. This signals that consumers and investors are becoming more savvy to deceptive practices and many want change.

What Is the SEC Doing About Greenwashing?

For some time now, the SEC has been discussing mechanisms to crack down on greenwashing.

Despite the growing popularity of ESG funds, many funds include investments that aren’t green, but that are highly profitable, in order to offset lower-profit green investments. Fund managers are under pressure to ensure their funds remain competitive and deliver optimized returns for investors. And sometimes that means padding green funds with dirty investments.

While the majority of ESG funds focus on sustainability and environmental protection, a small but growing number support other social issues, like LGBTQ+ rights.

March 2021

In March 2021, the SEC formed a Climate and ESG Task Force within their enforcement division to use existing laws to fine companies involved in greenwashing and to proactively identify ESG-related disclosure and investment misconduct. Although enforcement was proving difficult due the fact that greenwashing remained undefined, the SEC started fining companies for making misleading statements about their ESG funds.

August 2023

In August 2023, the SEC issued subpoenas and launched investigations into several assets managers relating to their green marketing claims. Though the details of these investigations are still unknown, it does indicate that the SEC is paying closer attention to these claims.

September 2023

Then, on September 20, 2023, the SEC announced amendments to the “Names Rule” made under the Investment Company Act, signaling a deeper crack down on greenwashing.

The Investment Company Act of 1940 contains regulations that require companies to disclose information about their investment policies and financial conditions to investors on a regular basis. These changes to the Names Rule and related naming regulations are intended to modernize the Act and promote enhanced transparency, accountability and integrity.

During the announcement, SEC Chair Gary Gensler commented, “As the fund industry has developed over the last two decades, gaps in the current Names Rule may undermine investor protection. Today’s final rules will help ensure that a fund’s portfolio aligns with a fund’s name. Such truth in advertising promotes fund integrity on behalf of fund investors.”

As a result of the amendments, any funds that suggest a specific focus based on its name (e.g., funds that use words like “green”, “sustainable”, “ethical” and so on in its name), must ensure that at least 80% of its investments are actually invested in a way that aligns with that name. Funds are now also required to review their assets at least every quarter to ensure they’re meeting this threshold, and if they find they’re out of compliance, they have 90 days to rectify it.

Finally, the amendments also roll out new disclosure and record keeping requirements, including:

- enhanced prospectus disclosure requirements for terminology used in the names of funds

- the requirement that any term used in a fund name that suggests an investment focus must be consistent with that term’s plain English meaning; and

- additional record keeping requirements for compliance with names-related regulations.

Dissenters to these changes argue that the new requirements may end up wiping out ESG funds, saying that many ESG funds were already underperforming and now the 80% rule may make them no longer a viable investment option. Others say SEC’s requirements, “would be impracticably subjective, cause confusion among investors, and encourage superficial judgments based solely on names.”

Regardless of opinion, the SEC’s crack down on greenwashing of ESG funds isn’t going away anytime soon, and it’s only likely to increase.

Moving Forward: How To Avoid Greenwashing at Your Organization

The SEC isn’t the only player posing legal risk for investment funds involved in greenwashing. State-level legislation is also being passed to combat ESG misinformation. Additionally, environmental activists are bringing alleged bad actors to the public’s attention, creating risks for those actors’ reputations.

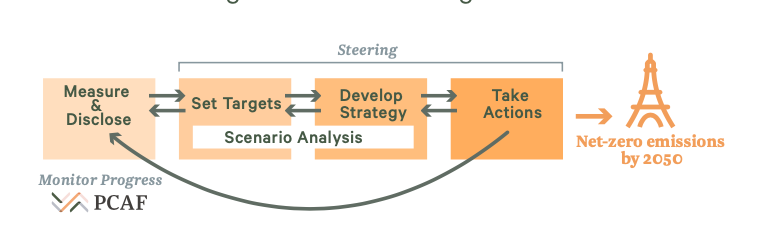

Moreover, the tightening of rules isn’t just restricted to ESG funds. The requirement to disclose information in an accountable and transparent manner is only increasing. The European Union approved the European Sustainability Reporting Standards in July 2023, and the SEC is set to release new rules around ESG reporting and climate disclosures Fall 2023.

The takeaway? Greenwashing is risky business.

Whether companies are concerned with investors, consumers, or both, there are many steps they can take to avoid greenwashing.

Of course, specific legislation and rules might apply to different scenarios, but as a general rule of thumb, companies should consider the following actions:

1. Commit to Transparency

When it comes to avoiding greenwashing, a true commitment to transparency is the first step. Don’t disseminate vague, non-specific claims that leave people with more questions than answers. Instead, share concrete claims openly and honestly and make sure your information is backed up with verifiable evidence, data and metrics.

Additionally, don’t just share your wins. Being transparent about both your achievements and shortcomings is what builds trust. If you didn’t meet a target, be honest about it, take ownership and show how you’re working to achieve it.

To help you, consider creating a scorecard, dashboard or even microsites – like the ones offered by FigBytes’ Sustainability Platform – to keep your progress front and center, and enable your company to share important information with your stakeholders.

Transparency equals trust, and trust builds loyal customers. Though greenwashing might be tempting for short-term wins, it’s long term loyalty and brand equity that moves the dial.

2. Collect Auditable, Investor-Grade Data

It’s easy to make statements like, “we’re committed to protecting our rivers and oceans for generations to come” or “we stand for climate action, now”. However, most consumers are waking up to the fact that those sorts of statements are often indications of greenwashing.

Instead of making marketing-speak claims, set a few realistic KPIs and work towards them. Collect auditable, investor-grade data about them. Start with KPIs that you know you can track, and make sure your data is rock-solid. Don’t try to tackle too much at once, or your data might be too thin.

With a tool like FigBytes’ Sustainability Platform, you can manage your data easily by centralizing data collection, calculations and analytics. You can even automate reporting and track your progress along your whole supply chain.

3. Be Consistent

When a product rebrands their packaging to use green tones, add natural images or include logos of unverified certification programs, it can be an indication of greenwashing.

It’s easy to change up your branding, put out ads about how green you are, and share a news story or two about a donation you made. But, it’s much harder to do the real work, and share your efforts on a consistent, year-over-year basis.

A true commitment to ESG isn’t a one and done exercise. It can’t be accomplished in a quarter. And it certainly won’t come about through a packaging design change. The better approach is to put the work in, track your progress over months and years, and share this honest and verifiable information with your stakeholders on a regular basis.

With steady, consistent progress, the market will notice your efforts and you’ll build credibility and trust that adds lasting value to your organization.

Fight Back Against Greenwashing Today

As the regulatory, reputational, and litigation risk of greenwashing increases, there are many things your business can do to develop an ESG program based on accountability, transparency and trust. FigBytes can help you get there.

To see how FigBytes can automate and streamline your ESG data collection, management, and reporting processes, reach out today and speak to a FigBytes expert.