In today’s business landscape, sustainability has emerged as a critical aspect of corporate responsibility. As companies strive to minimize their environmental impact and enhance their social contributions, the need for formalized sustainability reporting becomes increasingly apparent.

The concept of sustainability has expanded over the last decades to encompass so much more than “going green” and the available standards that could form the backbone of a corporate sustainability report make up a veritable alphabet soup of acronyms. While they all have some overlap, they each are designed to prioritize specific elements of sustainability depending on the sector and region.

Among the various frameworks available, the Greenhouse Gas (GHG) Protocol stands as a widely recognized and respected methodology for measuring and reporting corporate greenhouse gas emissions.

If you’re just starting to design your sustainability report and your focus lies on carbon reporting and meeting Net Zero targets, the GHG Protocol will provide you with high quality data that provides value to your organization and stakeholders.

Benefits of GHG Reporting

Why undertake GHG reporting at all? These days it can feel like everyone from small businesses to multinational organizations claims to be sustainable. But that’s actually a good thing.

The deadlines to meet our obligations under the Paris Agreement are approaching. By 2030, businesses will have to have reduced their carbon emissions by 30% from baseline numbers.

If you’ve looked at the news lately, it feels like there are stories of extreme weather – from wildfires to droughts to floods – every day all over the world. The opportunity to prevent climate change has passed. All we can do now is mitigate the damage by slowing rising temperatures.

Beyond slowing climate change, which takes contributions from all levels of business and government, companies undertaking climate action can see a number of other benefits, including:

- Enhanced Corporate Reputation and Brand Value

GHG reporting demonstrates a company’s commitment to sustainability and responsible environmental practices. By disclosing their GHG emissions and reporting on year-over-year reductions and showcasing efforts to reduce them, businesses can build a positive reputation among customers, investors, employees, and other stakeholders.

- Responsible Investment Opportunities

With more and more investors focusing on environmental, social, and governance (ESG) factors in their decision-making process, businesses that actively engage in GHG reporting and reduce their carbon footprint are more likely to attract responsible investors. Actively striving toward meeting ESG goals can enhance corporate resilience and profitability, giving these companies an advantage in the eyes of investors and financial institutions.

- Cost Savings

When we talk about energy efficiency in the context of sustainability, a lot of emphasis is put on backend emissions like carbon dioxide. But as businesses identify areas with high emissions, they can also identify opportunities for improved resource efficiency and cost savings.

Implementing energy-efficient technologies, adopting renewable energy sources, and optimizing processes can lead to reduced operational costs and enhanced competitiveness.

- Reduced Regulatory and Legal Risks

As governments worldwide intensify efforts to combat climate change, environmental regulations are becoming more stringent. By voluntarily engaging in GHG reporting, businesses can proactively identify areas of non-compliance and work towards meeting regulatory requirements.

Companies who proactively assess their climate risks are better positioned to adapt to evolving climate policies, while reducing the risk of potential fines, penalties, or reputational damage associated with non-compliance.

- Improved Supply Chain Resilience

Modern GHG standards take a holistic view of sustainability, recognizing that no business operates in a vacuum, and that maximum benefits can be achieved by understanding climate impacts, risks, and opportunities up and down the value chain.

The GHG Protocol and other standards require that reporting not only assesses an organization’s direct emissions (Scope 1) and energy consumption (Scope 2) but also considers emissions associated with its supply chain (Scope 3).

By evaluating the carbon footprint of suppliers and partners, businesses can identify vulnerable points in their supply chain and work collaboratively to reduce emissions collectively.

- Enhanced Employee Engagement and Talent Attraction

The labor market of the 2020s has seen drastic change compared to past decades. Employers have to work harder than ever to attract and retain talent. Employees are increasingly seeking purpose-driven workplaces that prioritize sustainability and environmental responsibility.

GHG reporting signals a company’s commitment to addressing climate change and promoting a greener future. Engaging employees in sustainability initiatives and reporting progress can foster a sense of purpose, pride, and commitment to the organization’s mission. Additionally, it can attract top talent, especially among younger generations, who are passionate about environmental causes.

- Innovation and Competitive Advantage

Sustainability reporting can act as a catalyst for innovation within a company. The pursuit of emission reduction targets often drives organizations to explore new technologies, products, and services to help them reach their sustainability goals. These innovations can lead to a competitive advantage as businesses differentiate themselves in the market.

What Is the GHG Protocol?

The GHG Reporting Protocol, sometimes called the GHGRP, was developed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD).

While other sustainability and ESG standards may focus on many different elements including water and forest conservation, diversity and inclusion, ethics and transparency in leadership, the GHG Protocol focuses exclusively on GHG emissions. It provides a standardized and transparent methodology for companies to measure and manage their carbon footprint accurately.

The GHG Protocol is designed to be implemented across sectors and geographic regions. As such, the requirements can be broadly interpreted to make them relevant to organizations regardless of their business activities. They include reporting on three scopes of GHG emissions.

What Are Scope 1, 2, 3 Emissions?

As discussed above, successful implementation of GHG-reduction targets and programs requires a holistic approach that isn’t limited to a business’s activities within their own facilities. As such, the GHG Protocol requires reporting on scope 1, 2, and 3 emissions.

At first glance there can appear to be a lot of overlap between the scopes, and it’s important to understand how they’re different so reports don’t double count emissions.

- Scope 1: Direct emissions from sources that the company owns or controls, such as emissions from company-owned vehicles or on-site manufacturing processes.

- Scope 2: Indirect emissions generated from purchased electricity, heat, or steam consumed by the company.

- Scope 3: Indirect emissions occurring in the company’s value chain, including emissions from suppliers, customers, and transportation of goods.

Successfully measuring or estimating emissions from all three scopes means collecting information from a variety of different people and departments within your organization, as well as others up and down the supply chain.

The GHG Protocol Corporate Standard

Because the GHG Protocol is meant to be used by organizations regardless of sector or location, it is in fact divided up into a number of different standards, including a community standard for municipalities, and a product standard to help organizations understand emissions throughout a product’s full life cycle.

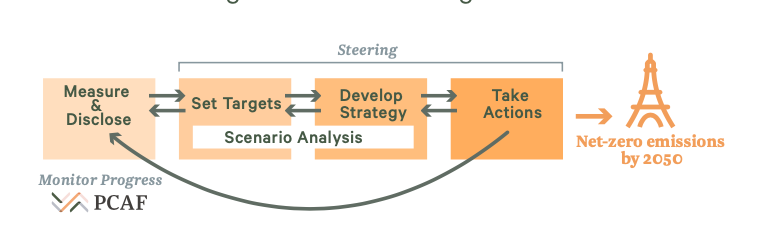

The Corporate Standard is designed to provide guidance for businesses on estimating their climate impacts as well as potential risks and opportunities in their operations. Completing reports in accordance with the standard involves six steps.

Step 1: Organizational Boundary and Scope Definition

For businesses new to sustainability reporting, the first step is to identify the organizational boundary and define the scopes. This involves determining the extent of the company’s operations, subsidiaries, and joint ventures to be included in the reporting.

Step 2: Data Collection

Accurate data collection is crucial for credible sustainability reporting. To start,

- Identify the sources of emissions within each scope

- Consider the type of energy used, fuel consumption, and business activities

- Contact relevant departments, such as procurement, operations, and finance, to gather the necessary data

Along with being accurate, data collection needs to be done as efficiently as possible. This phase is often where sustainability programs go off the rails. Reporting teams may spend so much time collecting data they don’t have time to bring value to the organization through implementing changes and striving to reach reduction targets.

Step 3: Emission Calculation

Once the data is collected, calculate the emissions for each scope using the emission factors provided in the GHG Protocol. These factors are region-specific and help convert energy consumption data into equivalent greenhouse gas emissions. Emission factors for processes like natural gas combustion have been used and verified for decades and are considered to be reliable high-quality data.

The GHG Protocol Corporate Standard includes calculation tools and guidance that can be used by a wide variety of reporting organizations. The tools include cross-sector calculators for emissions sources like stationary combustion that are present in a large number of businesses, as well as geographically- and sector-specific tools.

Step 4: Setting Targets and Goals

As part of your sustainability journey, it’s essential to set ambitious yet achievable sustainability goals. These targets can be based on various factors, such as reducing absolute emissions, improving energy efficiency, or promoting renewable energy use. Ensure that the goals are measurable and time-bound to track progress effectively.

Sustainability reporting isn’t a one-time event, and the changes needed to achieve documented targets can involve capital expenditures or process alterations. As such, it’s important to document year-over-year progress toward achieving targets and provide context for when you may be behind timelines, or where your efforts exceed expectations.

Step 5: Verification and Assurance

When possible, it’s recommended to seek external verification or assurance of the reported data. Independent verification adds credibility to the report and demonstrates the company’s commitment to transparent and accurate reporting.

Step 6: Reporting and Communication

Transparency is a critical component of sustainability reporting. Consumers, investors, and the community are all expecting companies to be open about their efforts to reach global GHG reduction targets.

Once your report is complete, a copy should be made publicly available. This is usually done through a company website, or the report may also be included with other documents like financial reports.

Overlap With Other Sustainability Standards

As we mentioned at the start, the GHG Protocol is one of many sustainability standards and frameworks available to businesses. While the GHG Protocol focuses exclusively on carbon emissions, others provide a bigger picture and include other areas of ESG.

You may find that your sustainability needs go beyond GHG reporting, or that investors and financial institutions are expecting a report compliant with a particular framework or standard.

The GHG Protocol is designed to complement other sustainability initiatives like the Global Reporting Initiative (GRI) standards or the proposed SEC Climate Disclosure Rules.

The goal of any program is never to create an undue reporting burden, but to help organizations understand how sustainability can be used to benefit business, reduce risk, and meet the goals and priorities set by financial institutions, government, and other stakeholders.

Ready To Start?

The GHG Protocol offers a robust framework for measuring and reporting greenhouse gas emissions, providing a solid foundation for businesses venturing into sustainability reporting. By following the protocol, companies can embark on their reporting journey with confidence, ensuring transparency, credibility, and a positive impact on both their business and the community.

But sustainability only brings value to the organization when reports are prepared conscientiously and the whole organization buys into the work required to meet targets. If all your team does is spend all year collecting data and building reports, there is no time left to follow through on opportunities and identify areas for improvement in achieving targets.

A partner like FigBytes can help get your sustainability program off on the right foot from the beginning. The all-in-one sustainability platform streamlines data collection so that it can be entered by the people who have the information at hand, rather than going through a tangle of spreadsheets and email chains.

FigBytes is designed to already be compliant with sustainability standards like the GHG Protocol. This means less of a learning curve for you. FigBytes will walk you through the necessary data collection and manage the calculations for you using the approved emission factor methodologies. The reports can also be customized to meet the needs of company leadership, stakeholders, and investors.If you’re ready to jumpstart your sustainability journey, FigBytes can help. The first 2030 Paris Agreement deadline is getting closer all the time, and we can help accelerate your progress so you can meet your targets and see real benefits for your organization. Contact one of our experts today to discuss your needs and find out more.